The Shape of Things to Come

Wednesday, 6 April 2011

March 3rd could have been a momentous day in the history of online gaming. It was the last day New Jersey Governor Chris Christie could have vetoed a bill allowing internet gambling in his State. If he had not acted by the end of the day, the bill would have become law.

As it was, he vetoed the bill, and sighs – either of relief or deflation – echoed around the internet. Why was the veto such a big deal? To answer that, we need to look back to 2006. A piece of legislation known in full as the Unlawful Internet Gambling Enforcement Act (UIGEA) was signed into law. Its aim was to make it illegal for Americans to gamble online, and the means to do so was to force US-based financial institutions to stop dealing with the internet gambling sites.

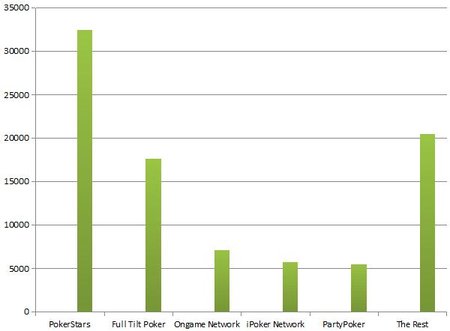

Some sites – notably Party Gaming, which was a listed company and by far the biggest player in the online poker market at the time – withdrew from the US market, and some sites stayed. Two of the sites who continued to provide online poker for US citizens in Party Poker’s absence now dominate the online gambling scene. As the following graph shows, they are responsible for over half the real money poker players on the internet (source: PokerScout.com):

Before the UIGEA, Party poker was approximately as dominant in the market as PokerStars is now. As Simon Holliday of H2 Gambling Capital puts it “liquidity is power - there’s virtuous circle in the online market where the more liquidity you have, the more punters flock to your site.”

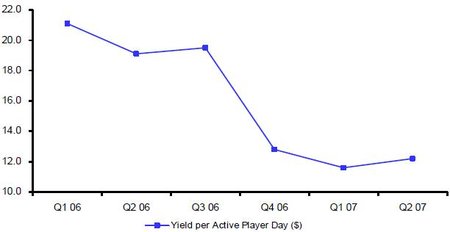

That point is underscored by considering how the liquidity of Party Poker decreased after the UIGEA. This following graph (source: Deutsche Bank) shows the drop in yield per active player day on Party Poker before and after the UIGEA – which was passed in October (Q4) of 2006.

This is actually the drop in yield for non-US players. In other words, the players who make up this statistic were not hampered in any way by the UIGEA – most likely they were unaffected European players. But their activity declines sharply in sync with the UIGEA nonetheless.

Why? Presumably the lack of liquidity from the departure of the US players was a turn off. Those players, whose banks blocked them funding their Party Poker accounts simply migrated to PokerStars and Full Tilt. The market has remained largely stable ever since.

In fact, Holliday notes that only twice in over a decade of online poker has there been any significant change such as this: once after the UIGEA, and previous to that when Paradise became a dominant runner at the first proliferation of online poker.

One could claim, thus, that power isn’t earned by a slow grind in online poker market. The system seems more like philosopher Thomas Kuhn’s vision of scientific revolution: long periods of stability punctuated by sharp, chaotic change. Perhaps armed with this view of the evolution of online poker, the claim that March 3rd could have been a momentous day does not seem an exaggeration. If Christie had passed the bill, the dam may well have broken for regulation of online poker in the US, and whoever was there to capitalise would surely have become a major player.

The problem in predicting this future is that it’s not clear who exactly will benefit when the US online market finally gets regulated. The major dichotomy here is between Federal and so-called intrastate regulation.

The New Jersey bill was an example of intrastate: one state attempting to go it alone and legalise online gambling within their borders. Holliday reckons that around 12-14 states have enough gambling interest to make that profitable. The obvious ones here are New Jersey, Nevada, Florida and California. For those states, it’s actually preferable to go it alone since they would generate millions in tax dollars for themselves, and not have to share it (so much) with the Federal Reserve.

State law is easier to pass than Federal legislation, because only one state needs to agree to it. Passing Federal law is, obviously, much more fraught. Even so, Christie had “legal and constitutional concerns” with the bill, largely revolving around how institutions other than those in Atlantic City could be regulated.

At the Federal level, Republican opposition to online gambling is strong enough that it’s possible regulation is still a long way off. I asked Chris Krafcik – a leading US-based independent analyst of internet gambling policy – what he thought the prospects were for Federal regulation. “I think it highly unlikely,” he said, “that the House of Representatives – which the Republicans now control via a 241-to-193 majority – will take up any internet gambling measure by regular order between now and January 2013.”

It’s hard to overstate just how much opposition there is among Republicans to online gambling. Krafcik points out that only one internet gambling-enabling regulatory bill (H.R. 2267) has ever received a vote in congress. However, that’s not even the whole issue. Even if regulation were to be passed – be it Federal or intrastate, it’s not clear who the beneficiaries would be. In the original draft of Harry Reid’s bill – the fire of which petered out towards the end of last year – it was made quite clear that those who flouted the original UIGEA (read: Stars and Tilt) would be punished by being passed over for the handing out of licences were internet gaming to become legal in the US. So the current mode is to believe that a Federal bill would disfavour Stars and Tilt, though perhaps a Federal bill is unlikely in the near future.

Regarding the prospects for intrastate bills, Krafcik notes that different intrastate bills take different stances on the inclusion of the offshore giants. California, for example, seems bent on shutting them out. Others seem happy to work with them. It seems as if everyone knows the gravity of this point in the history of poker, but no-one has any idea where the future will lead!

Either way, Stars and Tilt are lobbying hard for a piece of the pie. The US market makes up nearly a third of the global market, and as we saw from the fate of Party post-UIGEA, the fracturing of the market (and the liquidity loss thereof) spells a lot of uncertainty in the future. Given their current hold on the market, the “incumbents” are doing as much as they can to stay in front.

In one area at least, Stars have done their best to secure a reasonably healthy future. The EPT is definitely here to stay and a quick check on PokerScout.com shows that in liquidity terms PokerStars France and PokerStars Italy both rate in the top ten of global online networks – a quite staggering statistic.

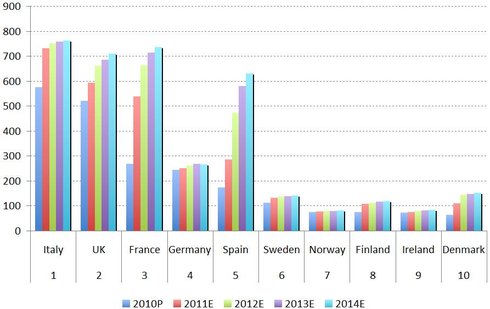

Granted, a US market reopened to regulation would be a fruitful one to whoever could benefit from it, but the untapped emerging markets are definitely where the prospectors are heading. After all, the US has already had its online gold rush. In France, Spain and Italy, the process is just starting, as this graph from H2 Gambling Capital shows:

We can see that Italy now figures to be the biggest European market for online poker (it was way behind the UK in 2009), but the biggest expansion is coming from France and Spain, who from small beginning, figure to be on a par with the UK in three years’ time according to the projection.

No wonder that a month or so ago Caesar’s announced the move of its WSOPE festival from London to Cannes. This move, in association with Barriere Casinos in France, is a statement of intent. Caesars understand that the emerging markets are the area of biggest growth and they need to stake their claim. The same argument presumably explains the move of the EPT Grand Final from Monte Carlo to Madrid.

For the individual player the future prospects are less unclear. We can know for certain that a more fractured market means smaller player pools – in other words, if everyone plays online poker within their state, the many-thousand player MTTs might be a thing of the past.

Secondly, if the governments do get involved – whether it be the US, France or Stoke-on-Trent, that’s money going out of the online game. To be sure, the addition of new French and Spanish players to the market spells fishiness for now, but we’ve seen from past experience that such money eventually dries up. With a certain percentage of that fishy money going straight to the authorities, that pool will dry up quicker.

Is it all doom and gloom? No, I don’t think so. Certainly, there will be a greater tie in between live and online as established online giants attempt to legitimise themselves by concentrating more on live events; just as bricks and mortar giants such as Caesar’s attempt to grab themselves a piece of the online market (with WSOP.com). That means bigger offline tournaments, more marketing spend (read: extra freebies) and better run tournaments, but it’s anyone’s guess who’ll be the market leader.

Predicting what happens next? Looks like it’s a bit of a gamble.